Inventory in Accounting: Definitions, Examples, & Challenges

Decoupling inventory is the process of setting aside extra raw materials so that manufacturing can continue, even during a supply shortage. Identify inventory that’s no longer selling, so you don’t waste money on stock that you can’t sell. This can also help you become more profitable by focusing your efforts on what’s in demand.

Periodic vs. perpetual inventory accounting systems

- Healthcare providers prioritize inventory traceability and regulation compliance.

- Use barcode scanning or radio-frequency identification (RFID) tagging to allow your staff to easily record and track stock levels and locations.

- Cost is defined as all costs necessary to get the goods in place and ready for sale.

- The next step is to deduct the cost of goods sold (COGS) from the beginning inventory balance.

- For instance, inventory is a current asset on the balance sheet, and its valuation affects the total assets reported.

This is especially true for larger businesses with multiple sales channels and storage facilities. Finished goods are products that go through the production process, and are completed and ready for sale. Common examples of merchandise include electronics, clothes, and cars held by retailers. The upper boundary, called the ceiling, is in place to remove the opportunity for a company to overstate the value of its inventoried assets. Costs of keeping inventory can come in many forms, and most of them are seen by the market as having the potential to negatively affect a corporation’s profitability.

Finishing the product

Basically, a count is performed periodically throughout the year to see what was sold and what was left. Although this is a very simple way to keep track of merchandise, it has many downsides. Each of these different categories is important and managing them is key to any business’ survival. Inventory control is one of the most important concepts for any business especially retailers.

Finished Goods Inventory: Definition & How to Calculate

Hence, the method is often criticized as too simplistic of a compromise between LIFO and FIFO, especially if the product characteristics (e.g. prices) have undergone significant changes over time. The impact on net income depends on how the price of inventories has changed over time. The inventory balance as of the beginning-of-period (BoP) is carried over from the end-of-period (EoP) inventory balance from the prior period. The beginning inventory is the starting point in the calculation of the ending inventory recognized on the balance sheet. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

However, there are some additional advantages to keeping track of the value of items through their respective production stages. Namely, inventory accounting allows businesses to assess where they may be able to increase profit margins on a product at a particular place in that product’s cycle. As noted above, inventory is classified as a current asset on a company’s balance sheet, and it serves as a buffer between manufacturing and order fulfillment.

Balance Sheet

See the table below for more on the effects of FIFO versus LIFO on your inventory accounting when prices are rising. The choice of inventory accounting method can have significant implications for a company’s profitability, affecting figures such as cost of goods sold, gross margins, and net income. The Weighted Average Cost method calculates the cost of inventory based on the average cost of all items available for sale during the period. This approach smooths out price fluctuations over time, which can be beneficial for businesses with large inventories or those that deal with commodities subject to volatile market conditions. Inventory accounting is a critical aspect of financial management for businesses that handle goods.

By hiring the right NetSuite accountant you get spot-on financial statements. However, unforeseeable events can occur that have a material impact on the inventory’s fair value, which must be adjusted for bookkeeping purposes to abide by accrual accounting standards (US GAAP). Since each product cost is treated as equivalent and the costs are “spread out” equally in even amounts, the date of purchase or production is ignored. Unlike IAS 2, US GAAP allows use of different cost formulas for inventory, despite having similar nature and use to the company.

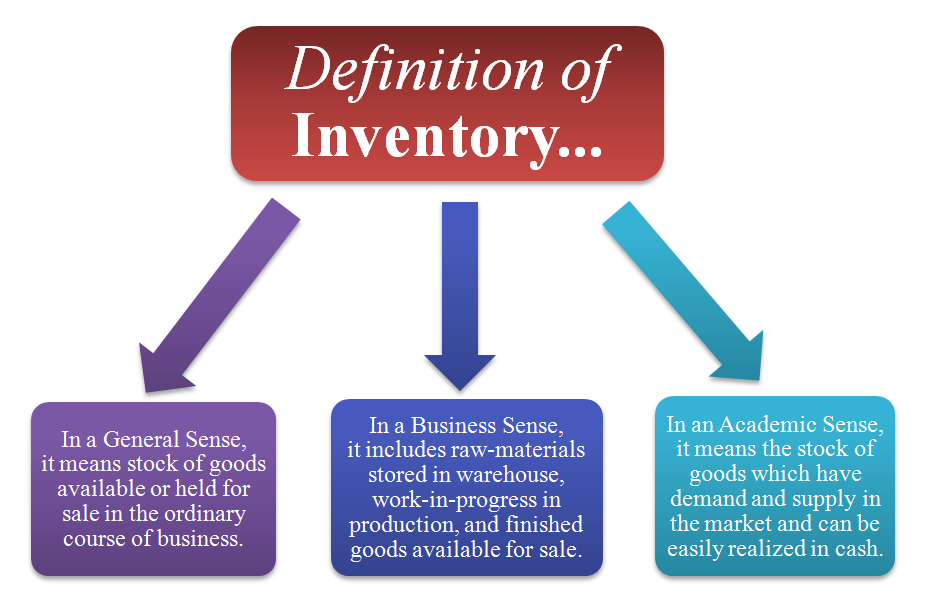

Inventory refers to a company’s goods and products that are ready to sell, along with the raw materials that are used to produce them. Inventory can be categorized in three meet the xerocon brisbane team different ways, including raw materials, work-in-progress, and finished goods. It’s always a good idea for companies to invest in a good inventory management system.

If a contract can be terminated without incurring a penalty, it is not onerous. KPMG has market-leading alliances with many of the world’s leading software and services vendors. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

No Comments