FIFO vs LIFO: How to Pick an Inventory Valuation Method

Inventory is often the most significant asset balance on the balance sheet. If you operate a retailer, manufacturer, or wholesale business, inventory may require a large investment, and you need to track the inventory balance carefully. Managing inventory requires the owner to assign a value to each inventory item, and the two most common accounting methods are FIFO and LIFO.

- Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses.

- There are a number of ways you can value your inventory, and choosing the best inventory valuation method for your business depends on a variety of factors.

- Therefore, it is important that serious investors understand how to assess the inventory line item when comparing companies across industries or in their own portfolios.

Is LIFO or FIFO better for taxes?

Our understanding of labor organizations and our daily involvement gives us the unique ability to be a resource to enable Executive Boards and governing bodies in making informed decisions. Regardless of your craft or jurisdiction, we possess the knowledge and resources to handle your accounting needs. ReportsRequiredRevised staff of over 40 accounting professionals servicing our labor clients throughout the year, we understand what it takes to service a labor organization. LIFO might be better for taxes if your product’s inventory value changes frequently. Start a free trial to explore how to reach new markets with Cin7’s inventory and order management system. Generally Accepted Accounting Principles set the standards for accounting procedures in the United States.

FIFO vs LIFO: Comparing Inventory Valuation Methods

Companies within the U.S. have greater flexibility on the method they may choose and can opt for either LIFO or FIFO. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit.

FIFO vs. LIFO: Accounting Methods and Their Impacts

And companies are required by law to state which accounting method they used in their published financials. FIFO can be a better indicator of the value for ending inventory because the older items have been used up while the most recently acquired items reflect current market prices. Since LIFO uses the most recently acquired inventory to value COGS, the leftover inventory might be extremely old or obsolete.

All costs are posted to the cost of goods sold account, and ending inventory has a zero balance. It no longer matters when a particular item is posted to the cost of goods sold account since all of the items are sold. By contrast, the inventory purchased in more recent periods is cheaper than those purchased earlier (i.e. older inventory costs are more expensive). So, which inventory figure a company starts with when valuing its inventory really does matter.

Because the expenses are usually lower under the FIFO method, net income is higher, resulting in a potentially higher tax liability. Under the LIFO method, assuming a period of rising prices, the most expensive items are sold. This means the value of inventory is minimized and the value of cost of goods sold is increased.

There are balance sheet implications between these two valuation methods. More expensive inventory items are usually sold under LIFO so the more expensive inventory items are kept as inventory on the balance sheet under FIFO. Not only is net income often higher under FIFO but inventory is often larger as well. Typical economic situations involve inflationary income tax return 2020 markets and rising prices. The oldest costs will theoretically be priced lower than the most recent inventory purchased at current inflated prices in this situation if FIFO assigns the oldest costs to the cost of goods sold. Some accountants in the U.S. advise using the LIFO method for your inventory accounting when you have stock with rising costs.

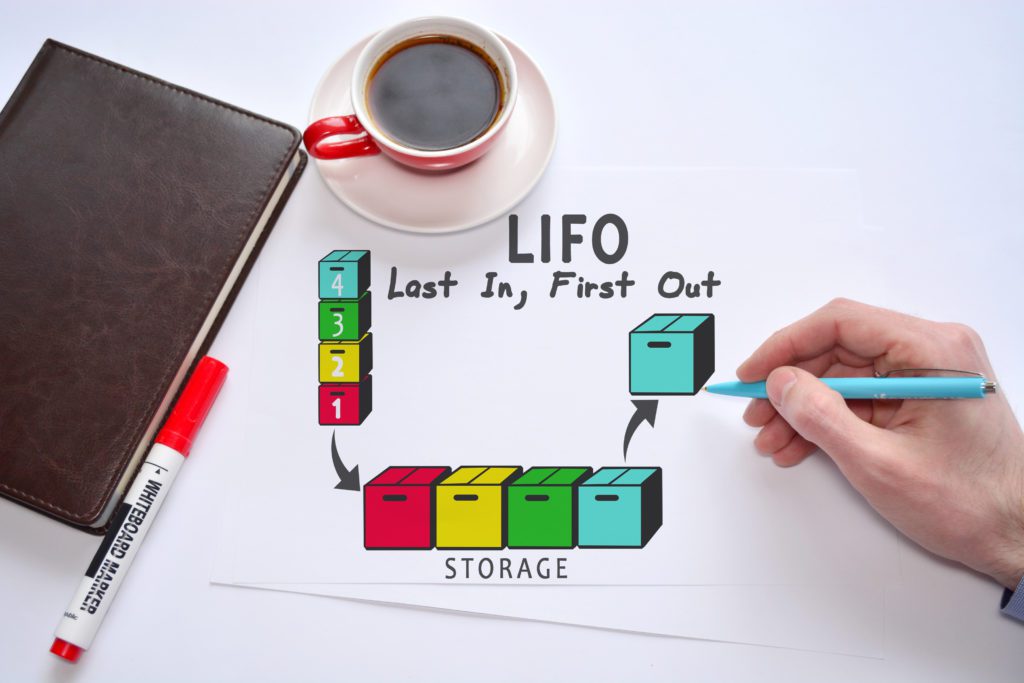

Cin7 was built with modern businesses in mind and only supports the FIFO method. Our inventory and order management software supports better accounting and offers a cloud-based solution that integrates all your sales channels into a single platform. Cin7 products provide advanced automation processes to create seamless transactions centered around a positive customer experience. It’s a method of inventory management and valuation in which goods produced or acquired most recently are recorded as sold first. In other words, the cost of the newest products is counted in the COGS, whereas the price of older goods is counted in inventory.

FIFO and LIFO are the two most common ways businesses manage their inventory, influencing how they calculate cost of goods sold (COGS), inventory value, profits, and more. LIFO, short for last-in-first-out, and FIFO, short for first-in-first-out, are two inventory valuation methods that yield different net profits and inventory values for tax purposes. The FIFO method can show inflated earnings due to using older inventory costs against new pricing.

No Comments